If you’ve ever wondered how your budgeting app seems to know what you spent at Starbucks yesterday, or how your new savings app links seamlessly with your bank account then you’re already witnessing the magic of open banking APIs in action.

But really, how do open banking APIs work, and what’s happening behind the scenes every time you link your financial information to a third-party app?

It’s a question more consumers are starting to ask as open banking USA initiatives continue to grow. In this article, we’ll explain the technology in the simplest way possible, break down what it means for your daily life, and help you feel more in control of your financial journey.

What Is an Open Banking API?

To understand how open banking APIs work, let’s break down the term:

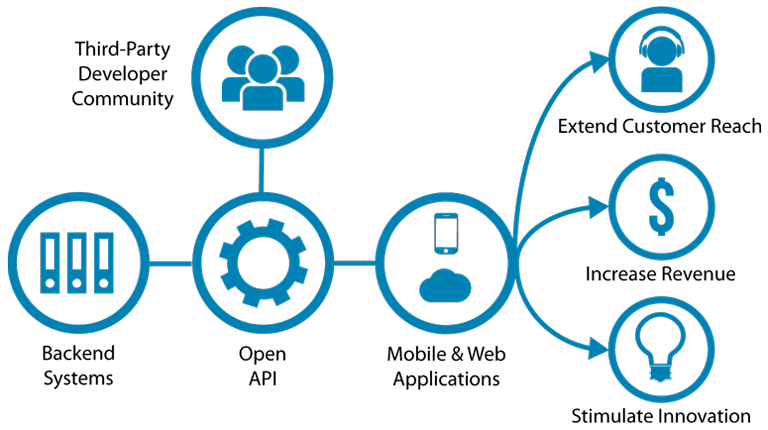

Open banking refers to the practice where banks and financial institutions allow third-party apps or services to securely access your financial data with your permission.

API stands for Application Programming Interface. It’s like a translator or connector that allows two software systems to talk to each other.

So, an open banking API is simply a secure digital bridge that lets your bank and a third-party financial service exchange information safely.

Still not clear? Let’s imagine your bank account is a house, and an API is the front door key you give to your favorite budgeting app. The app can come in, take a look at your receipts, and help you organize your spending, but it can’t touch your money unless you say so.

How Do Open Banking APIs Work in Practice?

Let’s use a real-life scenario to illustrate this:

Step 1: Permission

You download a money management app and decide to connect your bank account. The app asks for your permission and explains exactly what data it will access, like your account balance or transaction history.

Step 2: Secure Connection

Once you approve, the app sends a request to your bank using an open banking API. This API ensures that your data is encrypted and shared securely.

Step 3: Data Sharing

The bank responds with your requested data, such as the last 90 days of transactions, which the app uses to display charts, spending categories, or savings tips.

Step 4: Ongoing Sync

As you continue using the app, it can fetch new transactions regularly without storing your credentials. You stay in control, and you can revoke access at any time.

No passwords shared. No risk of unauthorized transfers. Just smart, transparent data sharing.

Why Should the Average Person Care?

Open banking may sound like a concept reserved for techies or finance pros. But really, it’s about making your financial life easier and more customized.

Here’s what it could mean for you:

Faster loan approvals based on real-time data, not outdated credit scores

Budgeting apps that adapt to your lifestyle and spending habits

Personalized investment tips based on your actual income and expenses

Better financial control without jumping through old-school banking hoops

Open banking is reshaping everything from daily money management to long-term financial planning.

Is It Safe to Use Open Banking APIs?

Yes, and that’s a valid concern.

When you use an open banking API in the U.S. or abroad, several layers of security and consent management protect you:

Encryption: All data exchanged is fully encrypted

Tokenization: Your actual login credentials are never shared with third-party apps

Read-only access: Unless you give explicit permission, most APIs only allow apps to view your data

Regulatory oversight: Companies like Plaid, MX, and Finicity follow strict security standards voluntarily, even without centralized U.S. laws

Stay cautious and use only trusted apps. Open banking APIs in the USA are generally safe when used responsibly.

What Is the Difference Between Open Banking and API Banking?

Here’s a quick comparison:

| Term | Meaning |

|---|---|

| API Banking | A general term for using APIs in banking systems for internal or external use |

| Open Banking API | APIs that enable consumer-authorized data sharing between banks and third parties |

| Banking-as-a-Service API | APIs allowing non-banks to offer banking services like payments or lending using a licensed bank’s infrastructure |

Open Banking API in the USA: Where We Stand

Unlike the UK or EU, open banking isn’t mandated by law in the U.S., but it’s growing fast through market demand.

Key players in the USA include:

Plaid – Used by apps like Venmo, Robinhood, and Chime

MX – Powers credit unions and financial wellness tools

Finicity – A Mastercard company working with lenders and credit apps

Yodlee – Known for financial data aggregation for institutions

Banks and fintechs are collaborating more than ever to deliver seamless financial services to users.

Examples of Open Banking in the USA

You’ve likely used open banking without even knowing it. Here are some real examples:

Venmo and PayPal

Linking your checking account to send or receive money uses open banking APIs.Mint or Monarch

These budgeting tools pull in real-time data from your bank accounts to help you plan and track spending.SoFi or Earning

These lenders use open banking APIs to review income and transaction patterns to approve loans faster.

How to Use Open Banking APIs for Developers and Businesses

If you’re building a fintech product, here’s how to get started:

Choose a provider like Plaid or MX

Register your app and get your API keys

Integrate endpoints or SDKs to handle data and account linking

Ask for permissions clearly to build trust

Test in sandbox mode before going live

Even if you’re not a developer, understanding this helps you choose secure apps and avoid shady services.

How Do APIs Work in Banking, More Broadly?

Even outside of open banking, APIs run the show. They power:

ATM withdrawals

Online payments

Bank statement views

Mobile logins

Real-time fraud alerts

APIs are the nervous system of banking. Open banking just opens them up to consumers.

The Future: Banking-as-a-Service and Embedded Finance

Banking-as-a-Service APIs let non-bank apps offer banking services. Here’s what’s possible:

A travel app offers insurance through a licensed bank

A ride-share app gives drivers instant payouts to a card

An online store offers buy-now-pay-later services using bank APIs

This embedded finance model is the future, and open banking APIs make it happen.

Final Takeaway

Understanding how open banking APIs work puts power in your hands.

Here’s what you can do now:

Use apps that offer secure open banking connections

Ask your bank about third-party permissions

Review your app permissions regularly

Learn enough to spot secure features and risky shortcuts

This is about your right to control, compare, and own your financial data.

Open banking APIs are here to stay. And now, you finally know how they work.