The Secret Engine Behind Your Favorite Finance Apps

Ever wondered how your budgeting app knows how much you spent on tacos last Friday or how your fintech tool pulls up all your accounts in one place? That magic? It’s powered by something called Open Banking APIs.

If you’re new to the world of APIs or fintech, don’t worry. This guide will break down Open Banking APIs in simple language, with examples, use cases, and practical takeaways. By the end, you’ll not only understand them, but maybe even want to build something with them.

What Is Open Banking?

Open Banking is a system where banks allow third-party apps (with your permission) to access your financial data securely. This lets you:

- View accounts from different banks in one app

- Share transaction history with budgeting tools

- Get better financial recommendations

Open Banking is all about giving YOU more control over your financial data.

What Is an API (and Why Does It Matter)?

API stands for Application Programming Interface. It’s basically a digital handshake that lets two apps talk to each other.

Think of it like this:

- Your budgeting app (like Mint or YNAB) wants data

- Your bank has that data

- The API is the safe tunnel that connects them

Without APIs, every fintech tool would need to build direct, one-off integrations with banks, which would be slow, expensive, and messy.

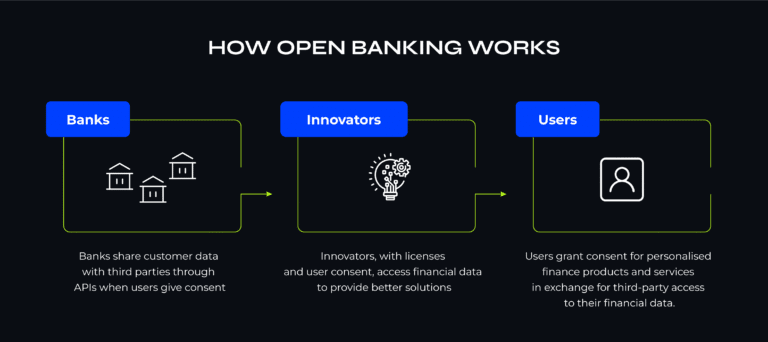

How Open Banking APIs Work (Without the Jargon)

Here’s the flow:

- You log in to a third-party finance app.

- It asks for permission to access your bank data.

- You log into your bank securely (often via OAuth).

- The bank shares only the data you allowed, through the API.

- The app uses that data to power your dashboard, insights, or features.

You stay in control the entire time.

Why Open Banking APIs Are a Big Deal

Open Banking APIs are powering the next wave of financial innovation:

- Personal Finance: See all your accounts in one app.

- Lending: Share your income and spending instantly with loan providers.

- Business Finance: Automate bookkeeping with tools like QuickBooks and Relay.

- Payments: Direct bank-to-bank transfers without needing card networks.

- Investments: Aggregate financial data for better robo-advising.

Basically, they make money smarter, faster, and more connected.

Examples of Open Banking API Providers

If you’re a builder or just curious, here are the platforms making Open Banking possible:

- Plaid: Probably the most well-known. Used by Venmo, Robinhood, Chime, and more.

- MX: Focuses on clean, categorized transaction data and personal finance.

- Yodlee: Popular with banks and institutions, it offers a wide range of data.

- Finicity (owned by Mastercard): Focused on credit and income verification.

- Akoya: A newer player backed by banks, built for secure data exchange.

These companies sit in the middle between your bank and your favorite apps.

Is It Safe?

Short answer: Yes, if used properly.

Open Banking APIs follow strict security protocols:

- Encryption: Keeps your data secure end-to-end

- Tokenization: No passwords are stored by third-party apps

- Consent-based: You control what’s shared and can revoke access anytime

Tip: Always check that your apps are using reputable providers like Plaid or MX.

How to Use Open Banking as a Consumer

You may already be using it without knowing. But here’s how to use it intentionally:

- Use apps like Monarch, Rocket Money, or Personal Capital to sync accounts

- Link your bank securely when setting up payment or investing apps

- Revoke access from any app you don’t use (check your bank settings)

You don’t have to code anything; use smarter apps.

Open Banking = Open Opportunity

Open Banking APIs are transforming how we interact with money. Whether you’re an everyday consumer who wants more control or a developer building the next finance unicorn, understanding this foundational tech is crucial in 2025 and beyond.

So next time your app knows your balance or flags an odd transaction, smile, you know what’s powering it.