Imagine this. You open a single app and see all your bank accounts, credit cards, loans, and investments, no matter which bank or service they belong to. You apply for a loan and get better rates because the lender can instantly access your financial history (with your permission). You switch banks effortlessly, without paperwork or delays. You save, budget, invest, and pay, all in one smooth flow.

This is not science fiction. This is the promise of open banking.

But what exactly is open banking? And why should it matter to you as a consumer?

In this article, we break down what open banking means, how it works, and what it could change in your daily life. We also explore the opportunities, risks, and smart ways to benefit from it. Whether you’re tech-savvy or just want better control over your money, this guide will help you understand what open banking really brings to the table.

1. What Is Open Banking? A Simple Explanation

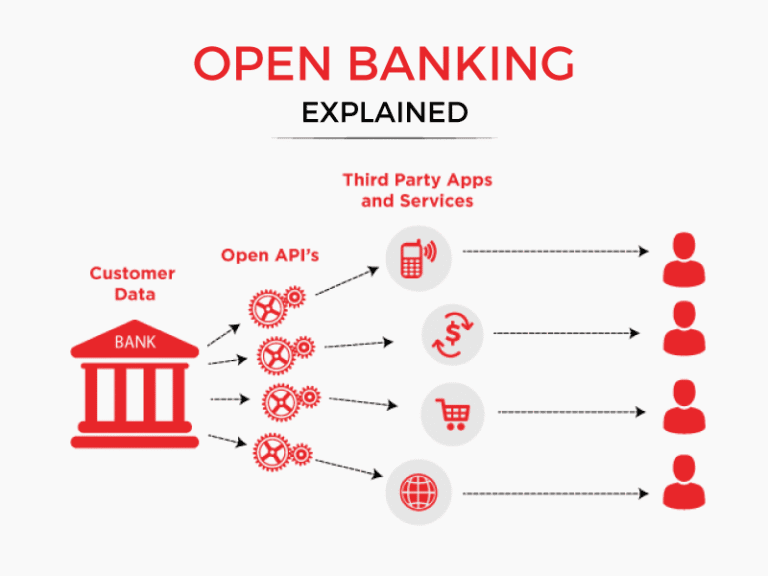

At its core, open banking is a system that allows banks to securely share your financial data with third-party providers, like budgeting apps, lending platforms, or investment tools, but only with your consent.

Traditionally, banks have held tight control over your financial data. Your transaction history, balances, and spending patterns stayed locked behind their digital walls. Open banking tears down those walls, legally and securely.

It does this through Application Programming Interfaces (APIs), tech bridges that allow secure communication between financial institutions and third-party apps.

So instead of copying and pasting account numbers, downloading spreadsheets, or manually managing multiple platforms, you get integrated financial services that talk to each other.

2. The Consumer Benefits of Open Banking

Open banking might sound technical, but its real power lies in what it unlocks for everyday people. Here are the biggest benefits:

A. More Personalized Financial Services

Open banking allows apps and services to understand your financial life in detail. Just like Netflix recommends shows you love, open banking allows tools to recommend financial actions that make sense for you.

Smart budgeting based on real spending patterns

Investment suggestions tailored to your risk tolerance and income

Better loan or credit card recommendations based on real-time eligibility

It is like having a financial coach in your pocket.

B. Faster and Cheaper Services

No more long waits for loan approval or credit assessments. With access to your verified data, companies can automate checks, lower risk, and offer you better terms.

Instant loan decisions

Lower fees or interest rates

Faster onboarding for new financial services

C. True Control Over Your Data

With open banking, you decide who gets to access your data, for how long, and for what purpose. And you can withdraw consent at any time.

That puts power back in the hands of the customer, not the institution.

D. Smarter Money Management

Want to see all your accounts across different banks in one app? Open banking makes that easy.

Consolidate your finances

Track spending in real time

Spot duplicate subscriptions or hidden fees

It becomes much easier to stay on top of your money when it is all visible in one place.

3. How Open Banking Works

Let’s say you want to use a new budgeting app like Emma or Mint. Before open banking, you’d manually enter your expenses or upload documents. With open banking:

You connect your bank account by logging in securely through the app

The app requests permission to access your transaction history, balances, and categories

You approve the request for a set period, say, 90 days

The app pulls in your data through a secure API and provides personalized insights

At any time, you can revoke access through the app or your bank dashboard.

No credentials are stored by third-party apps. Open banking systems are built with encryption, consent layers, and strict access rules. This is not screen scraping, it is structured, secure data sharing.

4. Who Are the Players in Open Banking?

Understanding who is involved helps clarify how open banking fits into your financial life.

A. The Consumer (You)

You control the flow. You authorize access to your data and decide how it’s used.

B. The Bank or Financial Institution

These are the “data holders”, your traditional banks or credit unions that store your account and transaction data.

C. Third-Party Providers (TPPs)

These are the apps or services that request access to your data to provide you with a product or service. They include:

Personal finance managers

Loan and mortgage platforms

Investment advisors

Fintech apps like Plaid, Yodlee, or TrueLayer (which act as data bridges)

D. Regulators

Depending on your country, regulators set the framework for how open banking must be implemented. In Europe, it’s PSD2. In the UK, it is led by the Open Banking Implementation Entity (OBIE). In the US, it is evolving under guidance from the Consumer Financial Protection Bureau (CFPB).

5. Real-Life Use Cases: How Open Banking Helps You Today

A. Applying for a Loan

Instead of printing out statements and waiting weeks, you connect your bank account to the lender’s platform. They access your real-time cash flow and decide in minutes.

B. Budgeting Apps

Apps like Cleo or PocketGuard can track spending, spot unusual charges, and help you set monthly goals using your actual banking data.

C. Switching Banks

Want to switch to a bank with lower fees? Open banking can let your new bank pull in your data, auto-fill forms, and even move direct deposits and bill payments, without the usual hassle.

D. Investment Platforms

Apps can analyze your bank transactions, calculate your available savings, and automatically invest spare change or extra cash intelligently.

6. The Risks: What to Watch Out For

As promising as open banking is, it is not risk-free. Being aware helps you navigate smartly.

A. Data Privacy Concerns

While your consent is required, not all third-party providers are equal in how they protect data. Choose apps that are regulated, transparent, and have clear privacy policies.

B. Fraud and Misuse

With data flowing more freely, fraudsters may try to exploit weak links. Always use secure apps, enable two-factor authentication, and monitor access permissions.

C. Overwhelming Choice

With so many services promising better budgeting, faster loans, or smarter investments, it is easy to overconnect. Stick with tools that solve real problems for you, not ones that just look shiny.

7. Open Banking vs Traditional Banking

| Feature | Traditional Banking | Open Banking |

|---|---|---|

| Data control | Bank-controlled | Consumer-controlled |

| Data access | Siloed in one bank | Shareable across platforms |

| Innovation pace | Slow and centralized | Fast and ecosystem-driven |

| App compatibility | Limited | Highly customizable |

| Consumer empowerment | Limited personalization | Highly personalized experiences |

Open banking does not replace traditional banking. Instead, it modernizes it, making it more flexible, open, and consumer-centered.

8. How to Take Advantage of Open Banking Safely

If you’re ready to explore open banking, here’s how to start smart:

A. Use Trusted Apps Only

Look for apps and platforms that are regulated, transparent, and well-reviewed. In many regions, open banking participants must be licensed or registered.

B. Review Permissions Regularly

Go into your banking app or platform settings and review who has access. Revoke permissions for apps you no longer use.

C. Enable Alerts and Security Features

Use notification tools for logins, access changes, or suspicious activity. It is your data, protect it.

D. Don’t Overshare

Only provide access to the data needed. If an app only needs account balances, do not share full transaction histories unless necessary.

9. What the Future Holds

Open banking is just the beginning. As the financial ecosystem becomes more connected, you can expect:

Open finance: Extending beyond bank accounts to include pensions, insurance, and mortgages

Embedded finance: Loans and payments built directly into apps like Uber or Amazon

Hyper-personalized banking: Where AI and open data work together to predict your needs and suggest solutions before you ask

Greater competition: Banks will have to innovate to keep up with agile fintech competitors

This means better rates, smarter tools, and more financial power in the hands of consumers.

10. The Bottom Line: Why This Matters Now

Open banking is more than a tech trend. It is a power shift, a quiet revolution that moves financial control away from institutions and toward individuals.

For you, that means:

Easier access to better services

More personalized tools for budgeting, saving, and investing

Faster, cheaper, more transparent financial decisions

Control over who sees your data, and when

Yes, it requires learning a new system. Yes, it comes with caution. But in exchange, it offers something we have long craved from money: clarity, convenience, and choice.

Conclusion: Your Money, Your Rules

In a world where every click, purchase, and paycheck is digital, open banking is a natural evolution. It does not ask you to become a financial genius, it simply gives you the tools to make smarter decisions, with fewer roadblocks.

So whether you are a student managing your first budget, a parent planning for college, or an entrepreneur juggling multiple accounts, open banking offers you a better way to bank, on your terms.

Your data. Your decisions. Your future.

It is time to bank better.